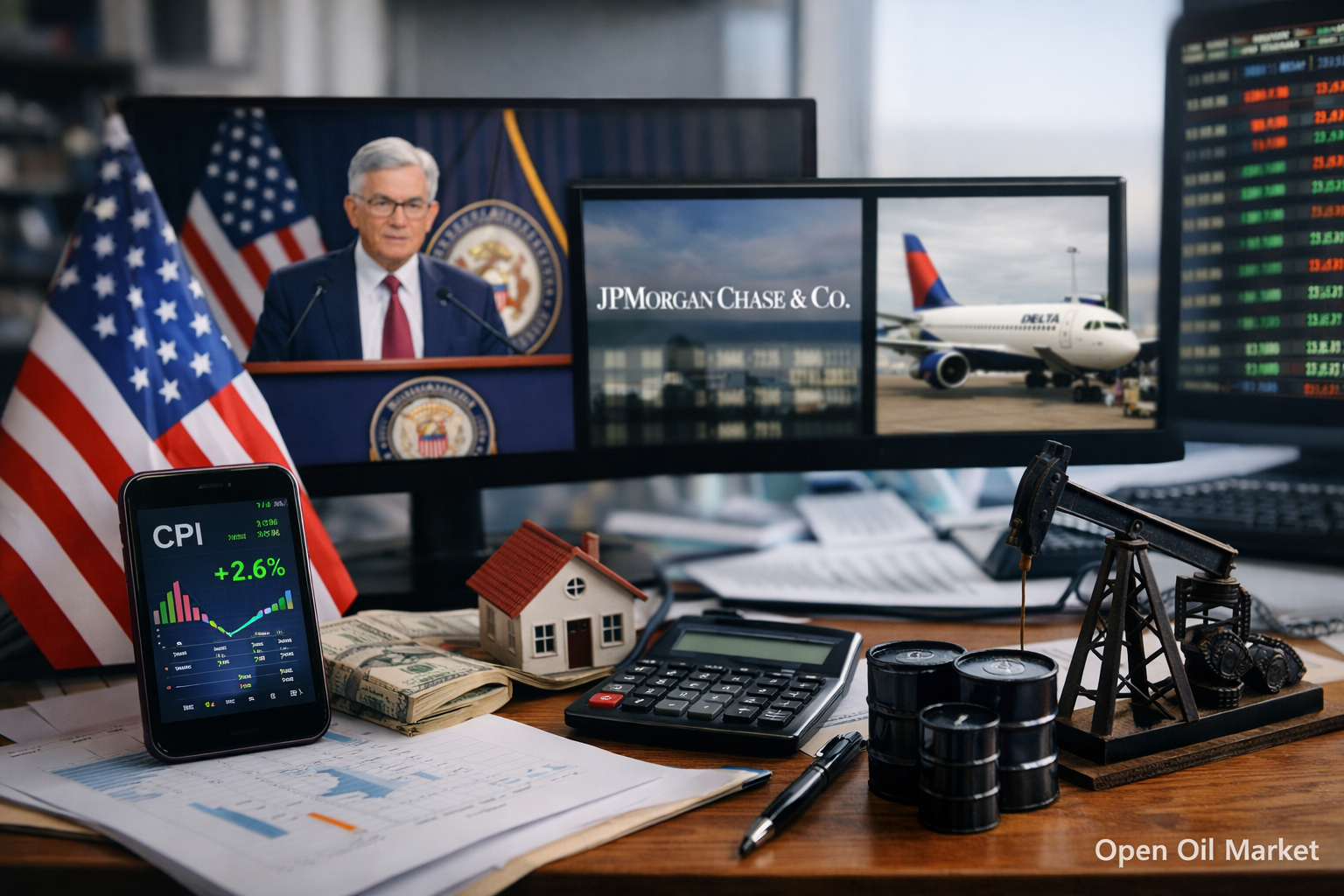

Global Economic Events and Corporate Reports for Sunday, January 11, 2026: U.S. Inflation Expectations, Kickoff of Earnings Season, Global Market Dynamics, and Key Indicators for Investors.

On Sunday, January 11, 2026, global financial markets are expected to exhibit a relatively calm environment. Key exchanges around the world are closed for the weekend, thus investor attention is drawn towards specific events. The spotlight of the day is the financial results release from major Indian IT companies Tata Consultancy Services and HCL Technologies. At the same time, market participants are already preparing for the upcoming significant economic events of the week, including the publication of U.S. inflation data (CPI), creating a sense of anticipation. Global stock indices, such as the S&P 500 (U.S.), Euro Stoxx 50 (Europe), and Nikkei 225 (Japan), ended the previous week with mixed results, reflecting investor sentiment at the start of the year. Likewise, the Russian Moex index did not demonstrate notable trends post-New Year holidays, in light of low market activity.

Market Sentiments

The beginning of the new week is characterized by relative calm across the markets. The absence of important statistical releases during the weekend contributes to low volatility. Investors are evaluating the conclusions of the first trading week of the year: in the U.S. and Europe, the business activity index showed mixed results, while the latest U.S. labor market data confirmed economic growth resilience. In this context, the American S&P 500 index barely changed by the end of last week, Euro Stoxx 50 in Europe exhibited limited growth, and the Japanese Nikkei 225 fluctuated around previously reached levels. The Russian stock market also proceeded through the first sessions of the year quietly, without significant changes in the Moex index. In the absence of fresh trading drivers on Monday, market activity may remain subdued, with global markets focusing on external signals and forthcoming events.

Macroeconomic Events

The economic calendar for Sunday lacks significant macroeconomic statistics publications. However, several important reports and indicators are lined up that could influence investor sentiment in the coming days. The main event of the upcoming week will be the release of U.S. inflation data – the consumer price index (CPI) for December, to be published on Tuesday. This indicator is crucial for assessing the Federal Reserve's future interest rate steps. Overall, the week ahead anticipates the following key events:

- Tuesday, January 13: UK labor market report (employment and average earnings), U.S. CPI publication for December.

- Wednesday, January 14: U.S. producer price index (PPI) and retail sales report for December.

- Thursday, January 15: Statistics on the Australian labor market (employment, unemployment rate), as well as publication of important macroeconomic indicators from China (trade balance and export-import figures).

- Friday, January 16: China’s GDP estimate for Q4 2025 release, final figures for Germany’s consumer price index for December.

The absence of data at the start of the week provides investors with time to reevaluate the accumulated information. However, starting Tuesday, market focus is set to shift towards inflation indicators: the CPI results from the U.S. could set the tone for movements in equity, commodities, and currency markets. Furthermore, the combination of U.S. inflation data alongside statistics from China and Europe throughout the week will establish a global backdrop that will govern market participant sentiments.

Company Reports in Asia

- Tata Consultancy Services (India): The largest IT company in India and one of the leading players globally, TCS, will publish its results for the third quarter of its 2026 fiscal year. Analysts forecast a revenue growth of approximately 4% year-on-year – a more tempered pace compared to about 5.5% a year earlier. This moderate growth reflects seasonal factors (fewer working days in December) and clients' cautious approach towards new projects amidst economic uncertainty in the U.S. and Europe. Investors will closely watch TCS management's comments on the demand for IT services and developments in artificial intelligence projects, as the company traditionally sets the trend for the entire Indian IT sector.

- HCL Technologies (India): Another leader in the Indian IT sector, HCL Tech, will report financial results for the same period. A moderate revenue growth (around 4–5% year on year) is expected, consistent with the previous quarter. The company, like other Indian software giants, faces ongoing weakness in client demand from the U.S. and Europe. Analysts do not anticipate an upward revision of HCL’s annual revenue guidance – management is likely to maintain a cautious outlook amidst external macroeconomic risks. The market will assess whether HCL has managed to improve its operating margin and which segments (e.g., cloud services or infrastructure) are demonstrating the most growth.

- Yue Yuen Industrial (Hong Kong): One of the world's largest footwear manufacturers (contract partner of leading sports brands) is set to release its December 2025 sales data. These figures will offer insight into consumer demand conditions in the global sports goods market at year-end. Previous months indicated a slowdown in sales amidst global economic uncertainty, thus investors will evaluate whether Yue Yuen concluded the year on a positive note. The dynamics of the company’s export sales also serve as an indicator of the state of international supply chains and demand from the U.S. and Europe.

- Other Companies: In addition to the above-mentioned firms, several smaller companies will also release their quarterly reports in Asia. For instance, Indian telecommunications and cloud services provider Sify Technologies will present results for Q3, while financial firm Anand Rathi Wealth will report on its asset management performance. Although their scale significantly lags behind giants like TCS and HCL, local investors may react to these reports, especially if results deviate notably from expectations. Overall, the Asian region is commencing the new week with an emphasis on India's tech sector and the indicators of industrial demand from China, forming the initial informational backdrop for trading on Monday.

Company Reports in the U.S.

The U.S. corporate calendar for January 11 is largely vacant, as the majority of U.S. companies do not release reports over the weekend. There are no significant quarterly reports scheduled from S&P 500 or Nasdaq constituents for this date. However, one smaller company is set to report:

- VOXX International (U.S.): A manufacturer of consumer electronics and automotive components, known for its automotive audio systems and accessories. VOXX will present its financial results for the third quarter of its 2025 fiscal year. Although the company does not fall into the “blue-chip” category, its sales and profit trends may provide indirect insights into the demand for durable goods in the U.S. Investors are evaluating whether VOXX has improved its performance amidst high competition and the recently concluded holiday season, which is crucial for the electronics sector.

It is noteworthy that in the U.S., the new earnings season virtually kicks off in just a few days: on Tuesday, January 13, several major U.S. banks, including JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup, will begin publishing results for Q4 2025. These financial sector reports will attract close attention and may set the overall tone for the U.S. stock market in the upcoming weeks. Beyond the banks, the latter half of the week is scheduled for reports from several tech and industrial companies, making the relatively quiet weekend pause in the U.S. merely a lull before the information deluge that will hit the markets with the start of the new week.

Company Reports in Europe and Russia

Neither Europe nor Russia has scheduled corporate reports for Sunday, January 11 – this is a typical practice as the main exchanges are closed. For European businesses, January is traditionally a period for preparing annual results: the majority of large EU companies will kick off their earnings season later, during the second half of the month and into February. Nevertheless, investors in the region are keeping an eye on external factors: signals from American and Asian corporations will be particularly important as they may influence sentiment at the week’s onset.

Russian public companies also refrain from releasing financial reports in the early days of the new year. Typically, the publication of results for Q4 and the entire previous year on the Russian market occurs significantly later – in late winter and early spring. Therefore, at the local level, the informational backdrop is relatively calm at this time. After extended New Year holidays, Russian investors primarily focus on global factors and the situation in commodity markets. In the absence of internal corporate events, the dynamics of the Russian market at the week’s start will depend on external news and the overall sentiment of global exchanges.

What Investors Should Pay Attention To

Given that Sunday is not packed with events, investors should utilize this pause to prepare for a week filled with activity. The spotlight will be on December inflation data from the U.S. – an unexpected surge or, conversely, a slowdown in CPI on Tuesday could significantly affect interest rate expectations and, consequently, the dynamics of the dollar and stock indices. Additionally, the kicking off of the earnings season, particularly the results from major U.S. banks and Asia’s tech companies, will set the tone for equity markets worldwide. By mid-week, volatility may increase, making it essential to assess risks and prepare for potential fluctuations.

Overall, the calm beginning of January 11 serves as the "calm before the storm." Global indices (S&P 500, Euro Stoxx 50, Nikkei 225, as well as the Russian Moex index) are soon expected to receive new momentum for movement. Investors in the CIS markets are advised to closely monitor international agendas: inflation data, regulatory decisions, and the first financial reports of the year will help form a clearer vision of economic directions and corporate profits for 2026. In circumstances of uncertainty, the ability to react swiftly to emerging information while maintaining a diversified and balanced investment portfolio will be crucial.