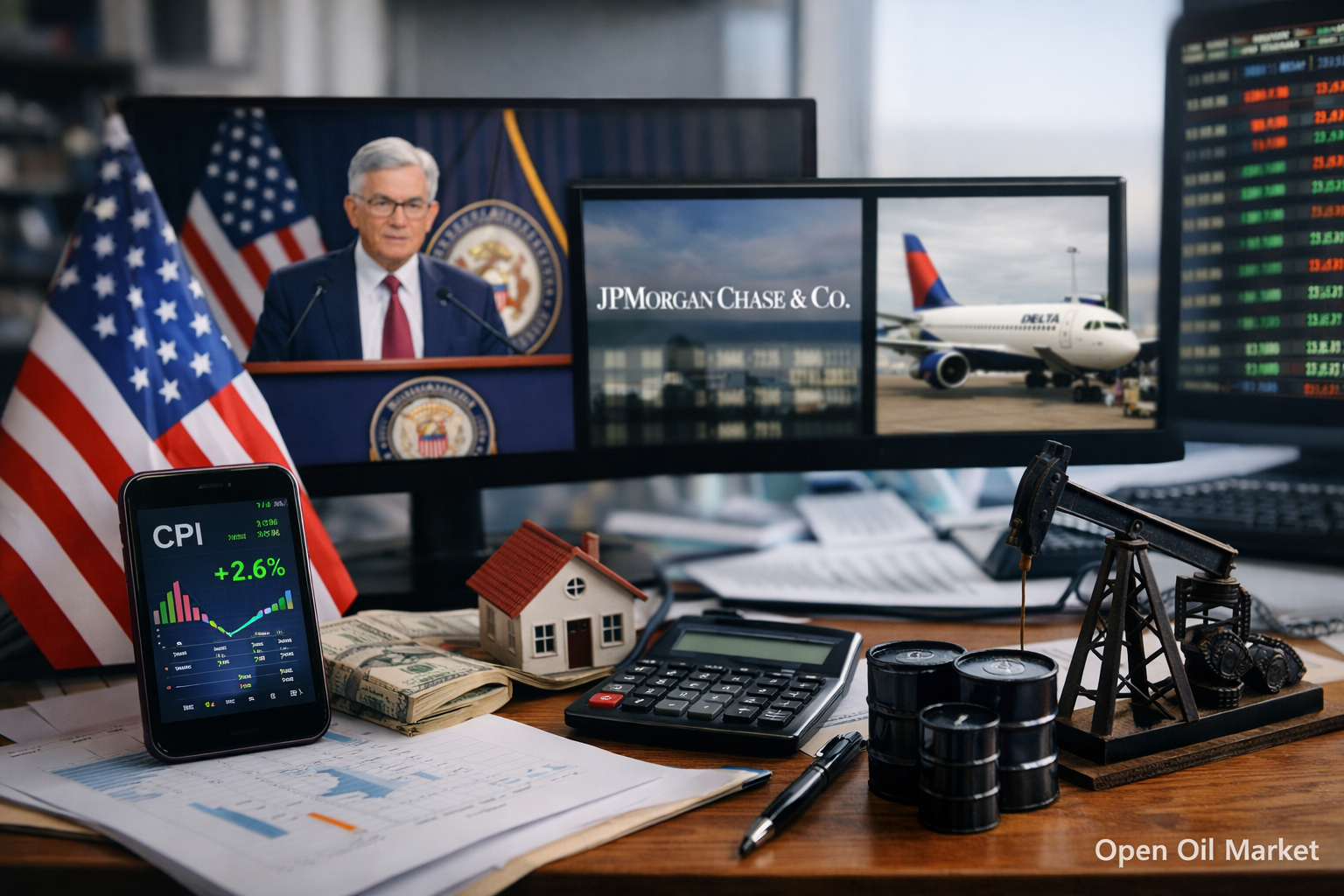

Key Economic Events and Corporate Reports for Saturday, January 10, 2026. Overview of Global Markets, Macroeconomics, and Public Companies in the US, Europe, Asia, and Russia. What Investors Should Watch For.

Saturday, January 10 – a traditionally quiet day in global equity markets. Major indices in the US, Europe, and Asia have shown a positive trend at the beginning of 2026: the S&P 500 has risen approximately 1% over the first week, as investors await the upcoming earnings season and key macroeconomic data. Among notable events of the day is the announcement of the quarterly results from India's DMart (Avenue Supermarts). In general, markets are focused on fundamental trends, including the US labor market situation, global inflation dynamics, and the prospects for the monetary policy of central banks.

US: Labor Market and Inflation

- In December, the US is expected to create around 60,000 jobs, with unemployment decreasing to 4.5%. These figures reflect a "no hire, no fire" mode in the labor market, bolstering confidence in the Fed's pause on interest rate hikes.

- The growth of average hourly wages is slowing, which alleviates inflationary pressure. However, investors are closely monitoring the December CPI and core inflation, which will be released early next week and serve as key triggers for the dollar and yields.

- US stock indices continue to reach new highs: the S&P 500 is at record levels. Market support comes from optimism regarding corporate profits and a softening of monetary policy. However, a sharp rise in yields could lead to a correction in the tech sector and increase funding costs.

Asia: China and Japan

- China: According to a partial survey by S&P Global, the index of business activity in China's services sector fell to 52.0 in December (a six-month low). Weak domestic demand growth and a decline in export orders heighten deflation risks, increasing expectations for new stimulus from the People's Bank of China. This is putting pressure on global commodity prices and emerging markets.

- Japan: Real disposable incomes fell by 2.8% year-on-year in November — the sharpest decline in a year. This decline is attributed to a significant reduction in one-off bonuses; nominal wage growth was only around 0.5%. Meanwhile, annual inflation in Japan stands at 3.3%, considerably exceeding income growth. This dynamic restrains consumer spending and compels the Bank of Japan to prepare for gradual policy tightening.

Europe: Germany and the Eurozone

- Germany: An unexpected decline in exports of 2.5% year-on-year in November signals ongoing weakness in external demand. The drop is attributed to reduced shipments to the EU and the US. On the other hand, industrial production rose by 0.8% in November – marking the third consecutive monthly gain. This indicates the beginning of a stabilization of internal demand and possibly a softening of the industrial downturn.

- Market Impact: Positive manufacturing data from Germany supports industrial sector stocks (DAX, Euro Stoxx 50) and the euro. However, if the statistics disappoint, cautious sentiment may return to European exchanges: investors could switch to bonds and gold, and expectations for ECB policy easing could strengthen.

Corporate Earnings: DMart and the Banking Season

Saturday has a rather modest corporate calendar — with the exception of India. Major companies in the US, Europe, and Russia are not releasing reports. The focus is on the retailer DMart (Avenue Supermarts), which will present its financial results for Q3 of the 2025/26 fiscal year (October–December).

- Avenue Supermarts (DMart, India): Analysts forecast that the retailer's revenue for Q3 2025/26 will rise by approximately 13% year-on-year (to around ₹17,613 crores). Net profit is expected to show moderate growth, but the operating margin is likely to shrink due to rising logistics and trading costs. Investors will closely monitor same-store sales dynamics and management's comments on pricing policy and network expansion.

- US Financial Sector: The earnings season for Q4 will kick off next week — major US banks (JP Morgan, Citigroup, Bank of America, Goldman Sachs, and others) will release their results from Tuesday to Thursday. These reports will provide insight into credit activity and the state of consumer spending in the economy.

Indices and Markets: S&P 500, Euro Stoxx 50, Nikkei 225, MOEX

- S&P 500 (US): The index has confidently started the year and is at historical highs. With expected corporate profit growth and support from soft monetary policy, investors are inclined to maintain a bullish outlook. Key factors remain the fundamental data: US inflation publications and bank results.

- Euro Stoxx 50 (Eurozone): The index is influenced by the macro calendar. Improved manufacturing data from Germany supports investor confidence, but a slowdown in exports creates uncertainty. The Eurozone is sensitive to currency dynamics (EUR/USD exchange rate) and the ECB's decisions; any negative external developments could lead to a correction in European markets.

- Nikkei 225 (Japan): The index continues to rise amid optimism regarding economic recovery and yen strengthening. However, the market is fundamentally constrained by weak growth in real incomes and cautious policy by the Bank of Japan. Earnings reports from Japanese companies, beginning at the end of the week (e.g., Yaskawa Electric), set the tone for the local market.

- MOEX (Russia): The index is guided by external factors — primarily oil prices and geopolitical risks. The ruble remains stable at around ~100 rubles/$, while oil holds above $60/barrel. In the coming days, investors will track the dynamics of budget oil revenues (expected to reach a three-year low in January) and the actions of the Central Bank in response to external shocks.

Day's Summary: What Investors Should Pay Attention To

- US Labor Market: The key trigger will be the employment and unemployment data. Their publication will determine the dynamics of yields and the dollar. A reduced job growth figure will support the Fed's dovish scenario, while an acceleration in hiring and wages may exert hawkish pressure on assets.

- China and Commodity Markets: Waning domestic demand activity in China threatens resource price growth. Investors should watch for signals of stimulus that may soon be announced by authorities, as well as the impact of Chinese statistics on emerging markets.

- Europe: Germany's industrial production index will confirm or deny hopes for Eurozone growth. Strong data will help strengthen the EUR/USD and support stocks in the Euro Stoxx 50, while weak data will intensify expectations for ECB policy easing and boost euro-denominated bonds.

- Corporate Reports: The release of DMart's results will provide insights into consumer demand in emerging markets. Following that, the reports from US banks will be crucial for assessing asset quality and the credit cycle. Reflecting these trends in corporate financial metrics will help in portfolio adjustments.

- Risk Management: With significant macro data releases and a busy earnings schedule expected, increased volatility is forecasted. It is advisable to predefine risk levels, diversify portfolios, and use hedging instruments (currency and interest rate derivatives) to protect savings.