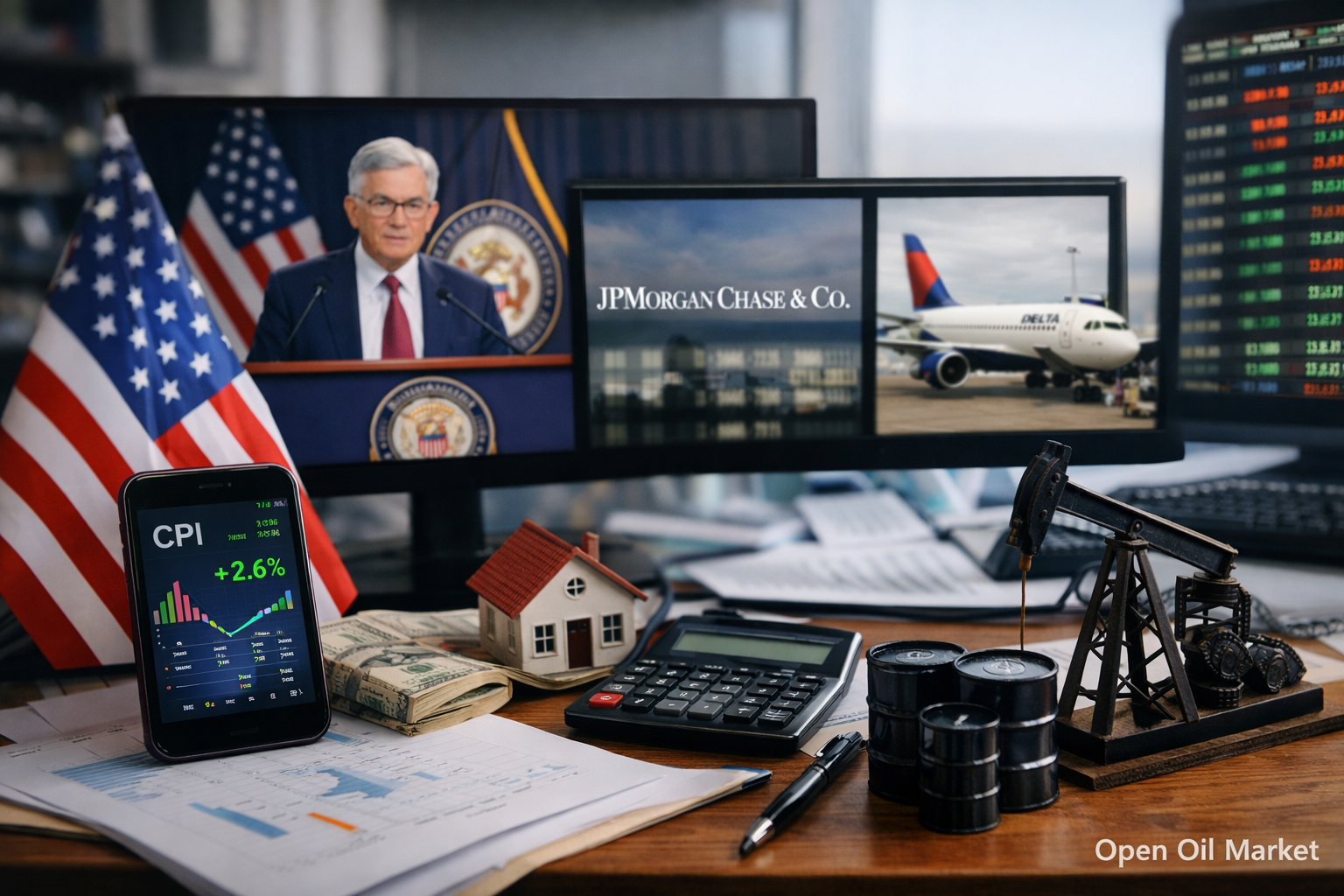

Detailed Overview of Economic Events and Corporate Reports on January 13, 2026. US CPI, Speech by the Bank of England Governor, US Housing and Budget Statistics, API Oil Data, as well as Financial Results from US, European, Asian, and Russian Companies.

Tuesday presents a packed agenda for global markets: investors are particularly focused on the December inflation data from the US, which has the potential to set the tone for the performance of risk assets. In Europe, attention is centered on the speech by the Governor of the Bank of England, which may impact the pound's exchange rate and market sentiment in the UK. Concurrently, the corporate earnings season for the fourth quarter kicks off in the US, as major banks and companies release their results, providing initial insights into the state of the business economy. The energy sector is closely monitoring the evening statistics on oil inventories (API) as a complement to the macroeconomic data released earlier. It is critical for investors to assess these indicators in conjunction: US inflation ↔ Fed expectations ↔ bond yields ↔ currencies ↔ commodities ↔ risk appetite.

Macroeconomic Calendar (MSK)

- 12:00 – United Kingdom: Speech by Bank of England Governor Andrew Bailey at the economic forum.

- 16:30 – United States: Consumer Price Index (CPI) for December.

- 18:00 – United States: New Home Sales (October data).

- 22:00 – United States: Federal Budget for December (monthly Treasury report).

- 00:30 (Wed) – United States: Weekly oil inventories as reported by API.

Key Aspects to Watch in US CPI

- Core Inflation (Core CPI): This key indicator will be pivotal for future Fed policy. Projections expect a slowdown in the core index to ~2.6% y/y; confirming this downward trend would bolster expectations for more accommodative monetary policy and support the stock market. Conversely, if Core CPI exceeds forecasts, it could intensify hawkish sentiments within the Fed, drive up Treasury yields, and exert downward pressure on equities, particularly in the technology sector.

- Price Structure: Investors will analyze the contribution of service (especially housing) and goods prices to the overall index. A slowdown in rental and service price growth would indicate diminishing inflationary pressures in these stable components. On the other hand, unexpected increases in these categories might signal persistent inflation inertia.

- Market Reaction: A sharp movement in the US dollar and bond yields can be anticipated immediately after the CPI release. A strengthening dollar amidst high CPI figures could decrease commodity prices (oil, gold) and currencies of emerging markets, while softer inflation data would weaken the USD and create a favorable backdrop for risk assets.

United Kingdom: Speech by the Bank of England Governor

- Tone of Monetary Policy Comments: Andrew Bailey's speech at 12:00 MSK will be a crucial event for the pound and the UK market. If the Governor indicates that inflation in Britain remains elevated and further policy tightening may be necessary, it could support the GBP and the banking sector while putting pressure on the FTSE 100. In contrast, softer, "dovish" signals (such as confidence in decreasing inflation and a pause in interest rate hikes) could weaken the pound, which might be positively received by exporters and shares of UK export-oriented companies.

- Assessment of the UK Economy: Investors will also look for hints regarding the state of the UK economy on the brink of 2026 in Bailey's remarks. Comments on growth rates, labor market conditions, and lending could adjust expectations regarding Bank of England policy. Any mentions of financial stability or the banking sector will be significant for understanding the regulator's risks and sentiments.

United States: Housing Market and Budget Indicators

- New Home Sales: The statistics on New Home Sales (for October) will provide additional insights into the state of the US housing market. Although this indicator is lagging, trends in new home sales reflect the impact of high interest rates on buyer demand. Improvement or stability in this figure could signal resilience in consumer demand, supporting shares of homebuilding companies, while a sharp decline would indicate a cooling housing market due to expensive mortgages.

- US Federal Budget: The evening Treasury report on the December budget will reveal the size of the deficit or surplus at year's end. A substantial deficit would remind markets of fiscal risks – rising public debt and possible increases in borrowing in the new year. While monthly budget data rarely impact the market immediately, the analysis is crucial for long-term investors: a trend toward increasing deficits could pressure bond yields over time and needs to be considered in strategies for 2026.

Earnings Reports: Before Market Open (BMO)

- JPMorgan Chase (JPM): The largest bank in the US will report before market opening. Investors are keen to see how high interest rates have affected net interest income and the bank’s margin. Focus will be on lending volumes and loan loss reserves: an increase in reserves may indicate management's caution regarding economic outlook. Furthermore, results from JPMorgan's trading and investment banking divisions for the fourth quarter will be critical: strong performance will suggest resilience on Wall Street, while weak investment banking results would confirm a continuing downturn in the M&A and IPO markets. JPMorgan’s guidance on the US economy and banking sector for 2026 will be a critical indicator for the financial market.

- Bank of New York Mellon (BK): One of the leading global custodial banks will present results before trading begins. For BNY Mellon, commission income from custodial and asset management services, dependent on market dynamics and institutional client activity, is key. Investors will want to assess whether the volume of assets under management/custody has increased amid market volatility at year-end. Another focal point will be interest income on client deposits: rising rates could improve margins but also encourage outflows to higher-yielding instruments. Management's comments on the state of global markets and capital inflows/outflows will guide European and US financial sector stocks.

- Delta Air Lines (DAL): One of the world’s largest airlines will report for the fourth quarter, including the holiday season. In Delta's report, investors will look for signs of consumer demand strength for air travel: high flight load factors and passenger volumes will suggest travel remains a priority for consumers despite economic conditions. Particularly important will be the dynamics of revenue per available seat mile (PRASM) and comments on airfares – reflecting the airline's ability to pass on increased costs (fuel, labor) to customers. If Delta improves its margins or offers an optimistic revenue outlook for 2026, it will support the entire airline sector. However, a cautious tone regarding business travel or costs could become a limiting factor for sector stocks.

- Concentrix (CNXC): An American provider of business process outsourcing will report before market opens. The company is known for offering contact center and customer support services to corporations worldwide. Investors are interested in the revenue growth of Concentrix amidst digitalization and the merger with Webhelp (the deal closed earlier in 2025) – synergies from the merger may enhance business scale. Profitability metrics will be scrutinized: whether the operational margin has been maintained considering integration costs and wage inflation in the services sector. Concentrix's forecast for corporate client demand in 2026 will signal whether companies continue to invest in customer service and IT outsourcing in an uncertain economic climate.

Earnings Reports: After Market Close (AMC)

- No significant releases are expected after the main session on Tuesday. The corporate calendar for the evening of January 13 is sparse – most major issuers from the S&P 500 and Nasdaq have scheduled their financial results for later days in the week. Consequently, investors will not see substantial corporate intrigue after the market closes, and the news backdrop in the evening will remain relatively calm.

Other Regions and Indices: S&P 500, Euro Stoxx 50, Nikkei 225, MOEX

- S&P 500 (US): On Tuesday, the US equity market enters a new earnings season. Morning releases from heavyweights like JPMorgan and Delta will set the tone for the financial and transport sectors. As the S&P 500 previously reached high levels, investors are closely assessing initial reports: can corporate earnings justify the market’s optimistic expectations? Additionally, the performance of the S&P 500 that day will be influenced by the CPI data – strong earnings from banks may shift focus from macroeconomics to micro-level performances, but unexpected inflation figures could provoke broader market fluctuations.

- Euro Stoxx 50 (Europe): No quarterly earnings releases are scheduled among blue chips in the eurozone for January 13. European markets will primarily rely on external factors – market reactions to US inflation data and signals from the UK. The absence of major corporate drivers in the euro index implies that macroeconomic news and currency movements (especially EUR/USD and GBP/USD post-Bailey's speech) might play a decisive role. Additionally, some local reports should be noted: for instance, British company Games Workshop (FTSE 250) will publish half-year results, and German agricultural holding Südzucker will report quarterly – these releases are important in their sectors but are unlikely to affect the broader market.

- Nikkei 225 (Japan): The Japanese market continues to publish results from companies with non-standard fiscal years. There are no significant reports from Nikkei 225 giants on Tuesday; however, investors are attentive to corporate news from smaller firms. In particular, one notable company – retail pharmacy chain Cosmos Pharmaceutical – will present financial results for the first half of the year, reflecting consumer activity in the pharmaceutical retail sector. Overall, trading activity in Tokyo will likely be influenced by the overall sentiment in global markets following the US data release: the Japanese index is sensitive to changes in risk appetite and yen fluctuations, so any surprises in the CPI could also impact the Nikkei 225's dynamics.

- MOEX (Russia): On January 13, no large issuers are expected to publish financial reports on the Moscow Exchange – the season for quarterly and annual results from Russian companies typically begins later in January and February. Some activity may be observed in terms of operational updates from individual companies or boards of directors regarding dividends, but these events are unlikely to significantly influence the MOEX index. The Russian market, in the absence of domestic drivers, will follow global market sentiment and oil price dynamics: US CPI data and external factors will set the primary direction for the ruble and the value of Russian assets on Tuesday.

Daily Summary: Key Points for Investors

- US CPI: The publication of inflation in the United States is the primary trigger for the day. Investors should prepare for a surge in volatility at 16:30 MSK: deviations in actual CPI from forecasts will instantly reflect on the dollar's exchange rate, yields, and global equity indices. Particular attention should be paid to core inflation; a slowdown could propel stock growth, while unexpectedly high figures may prompt discussions of new Fed actions and potentially lead to a short-term sell-off of risk.

- Speech by Bank of England Governor: Andrew Bailey's daytime address may shift expectations regarding UK interest rates. For investors dealing on the currency market, tracking GBP's response is crucial: any hawkish comments from Bailey could strengthen the pound and influence European financial shares, while a softer tone would have the opposite effect. This speech will also provide insight into regulator sentiments in Europe at the start of the year.

- Corporate Earnings in the US: The start of the earnings season sets thematic movements within the market. Strong results and forecasts from JPMorgan, Delta, and others before the market opens could support their respective sectors (banking, transport), shifting focus from macro stats to corporate stories. However, investors should compare corporate trends against the macro backdrop: for instance, even solid bank reports may be overshadowed by negative sentiment from high CPI, and vice versa, moderate inflation will amplify the positive impact of strong corporate earnings.

- Oil and Commodity Prices: The oil market will receive signals from the API report on crude oil inventories in the evening (00:30 MSK Wednesday). Although this indicator is preliminary, unexpected increases or decreases in inventories could trigger price movements in oil, impacting stocks in the oil and gas sector and currencies of resource-rich countries. Alongside inflation data (the energy component of CPI), this will help investors gauge the direction of the commodity segment. Commodity investors should stay alert after the close of main trading.

- Risk Management in a Busy Day: The combination of important macro data and significant earnings reports creates conditions for increased volatility. It is advisable to pre-determine acceptable fluctuation ranges for portfolios and set stop orders or hedging positions, especially when trading on a short horizon. In such an information-rich market, it is sensible to avoid excessive leverage and emotional decisions: it is better to wait for key indicators to be released and then make informed investment moves, relying on facts rather than forecasts.